By Noel Randewich

SAN FRANCISCO (Reuters) - Qualcomm Inc CEO Paul Jacobs promised on Wednesday to return 75 percent of free cash flow to shareholders through stock buybacks and increased dividends, a new commitment that was lower than some investors hoped for following record returns last year.

Unveiling his new capital return commitment, Jacobs said Qualcomm would increase dividends faster than earnings and continue repurchases as well.

Many investors have called for the debt-free and cash-flush company to distribute more profits to shareholders and make firm commitments rather than occasional buybacks. Its plans for capital returns have been a major question for analysts going into this year's investor day in New York.

'I was looking for something systematic rather than one-time - seems like we've got that,' said Bernstein analyst Stacy Rasgon.

Qualcomm is among a growing number of technology companies, including Yahoo Inc and Microsoft Corp, that investors have urged to pay out more capital as earnings growth loses steam. Activist investor Carl Icahn has urged Apple Inc CEO Tim Cook since August to buy back $150 billion in stock.

In fiscal 2013, Qualcomm returned $6.7 billion, or 86 percent of free cash flow, to shareholders in the form of $2.1 billion in dividends and $4.6 billion of repurchased stock. That percentage of cash return is a bit above average for companies in the Standard & Poor's 500 stock index, according to Cowen analyst Timothy Arcuri.

Earlier this month, Qualcomm committed to buy back $4 billion in shares in fiscal 2014 and pay $2.5 billion in dividends, but some on Wall Street wanted the chipmaker to make a long-term capital return commitment.

At the end of September, Qualcomm had $8 billion in cash onshore. It also had $21 billion offshore, which was held by foreign subsidiaries and would be taxed if the company brings it to the United States.

Qualcomm's shares traded down 0.1 percent after Jacobs' described the capital return plan. They are up 16 percent year to date, less than the S&P 500's 27 percent increase.

NEW CHIPS

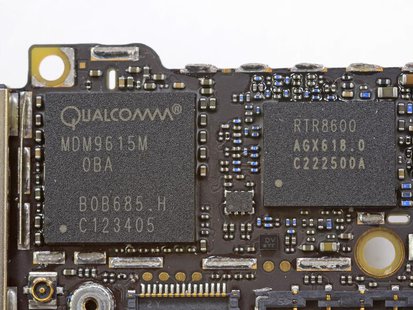

Earlier on Wednesday, Qualcomm announced a handful of new chips for mobile and networking gadgets ahead of the investor event, where analysts are concerned about a shift in smartphone growth from the United States to China and other developing countries.

Qualcomm said the fourth generation of its Long-Term Evolution chip, used for fast data transfer in top-tier smartphones, would begin sampling by manufacturing customers early next year.

Qualcomm is the world's leading mobile chipmaker and is far ahead of Intel Corp and smaller rivals in LTE technology.

With growth in the smartphone industry shifting away from wealthy markets such as the United States and toward China and other emerging economies, Wall Street has been concerned that less-expensive phones may affect Qualcomm's ability to sell high-end chips and hurt its profitability.

This month, Qualcomm said it would curb fast-growing operating expenses and release new chips a little less often as it focuses more on less-costly devices.

While the new LTE chips unveiled on Wednesday are for top-tier smartphones, some of the technology used in them will find its way into cheaper components used widely in low-cost handsets, Cristiano Amon, executive vice president and co-president of Qualcomm's chipmaking division, told Reuters.

The San Diego company also announced its newest Snapdragon 805 processors for tablets and smartphones, with new features for Ultra HD video.

The new Snapdragon chips will have up to 40 percent more graphics horsepower while using the same amount of battery power, Amon said.

Also, Qualcomm said that early next year, manufacturers would start selling routers and media servers with beefed-up Qualcomm processors that allow for more connections and Internet traffic within the home.

(Editing by Alden Bentley and Lisa Von Ahn)

Post a Comment